Parliament Ponders Merging Government Affirmative Funds to Stem Mismanagement

the audit revealed under-expenditure of provisioned funds with KSh 193 million still lying idle in spite of budgetary provision.

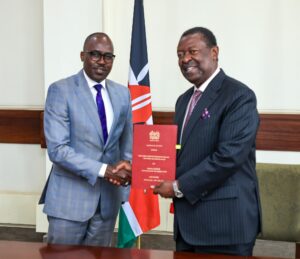

The National Assembly's Special Funds Committee, chaired by Fatuma Zainab, sounded an alarm on poor financial management of the fund and poor loan recovery process. Photo/Citizen Digital

By Juliet Jerotich

Members of Parliament are contemplating merging the Uwezo Fund with other government affirmative action funds in a bid to curb financial inefficiency and improve accountability. The action comes in the wake of the Uwezo Fund failing to adequately address significant audit matters outlined by the Office of the Auditor General.

The National Assembly‘s Special Funds Committee, chaired by Fatuma Zainab, sounded an alarm on poor financial management of the fund and poor loan recovery process. The committee reported that, in the absence of near-term reforms, consolidation of affirmative action funds focused on youth, women, and marginalized groups was the best option.

“The system being operated today lacks the necessary structures to facilitate accountability. Loans are disbursed without appropriate tracking, and it is extremely difficult to recover disbursed amounts,” Zainab said during a parliamentary session. “We are now left with no choice but to propose consolidating these funds for the sake of optimizing operations and ensuring safeguarding of public funds.”

Audit reports for the 2022/2023 and 2023/2024 financial years have a sorry tale to tell of Uwezo Fund’s performance. Out of ten audit questions, the fund was only able to answer three convincingly. Among the key areas of concern was that it failed to recover more than KSh 4 billion in defaulted loans during the 2022/2023 financial year.

In addition, the audit revealed under-expenditure of provisioned funds with KSh 193 million still lying idle in spite of budgetary provision. Undermanpowering was also evident, with only 21 personnel—largely seconded from the State Department—handling responsibilities originally meant for a team of 70 personnel.

In the following financial year, things were even worse as unrecovered loans went up to over KSh 5 billion. Others mentioned include the failure to distinguish between recurrent and non-recurrent receivables, a deficit of KSh 74 million, and excessive spending by KSh 58 million, again showing poor financial controls.

The committee noted that the payment issues were not limited to Uwezo Fund, as similar issues were encountered in the Women Enterprise Fund and the Youth Fund. Approximately 75 percent of loans made under these programs remain unpaid, and this has been raising fears of massive financial write-offs.

It can be seen that the funds were created with altruistic intentions, but they have been lacking in implementation. Without a proper repayment system, taxpayers risk losing billions,” warned Zainab.

The Special Funds Committee has now set a 14-day deadline to Uwezo Fund to provide satisfactory responses to Parliament as well as the Auditor General. The report will guide the future plan of action for the government, including consolidating the funds to make it more effective and reduce wastage.