Kenya Explores Launch of Diaspora Bond

Others who attended this meeting include Mr. Livingstone Bumbe, the Deputy Director for Public Debt Management at the National Treasury

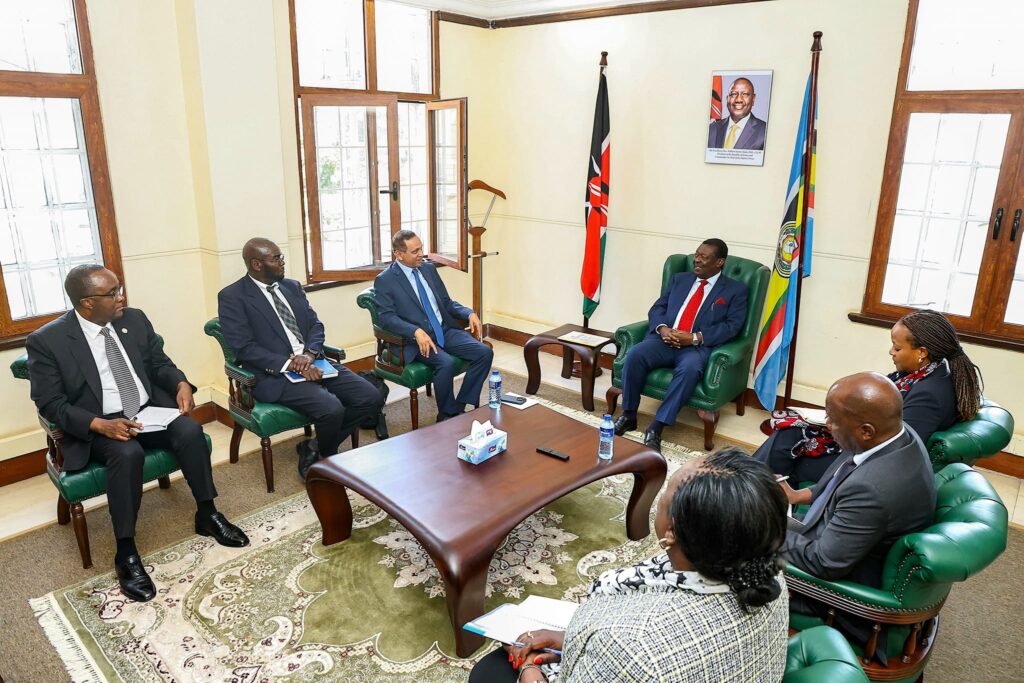

Prime Cabinet Secretary Musalia Mudavadi in a meeting with MIGA officiala.Photo/MusaliaMudavadi.

By Robert Mutasi

Prime Cabinet Secretary and also CS for Diaspora and Foreign Affairs Musalia Mudavadi on Tuesday hosted key stakeholders from the Multilateral Investment Guarantee Agency over Kenya’s intentions to float a Diaspora Bond, a strategic financial instrument designed to tap investments from Kenyans living abroad.

This strategic bond is expected to raise colossal capital for development projects in the country at a time when the government is seeking ingenious ways to finance its national development goals.

During discussions focused on how the Diaspora Bond could be a game-changer for Kenya’s economy, Mudavadi met with Ms. Nkem Onwuamaegbu, Africa Regional Head of MIGA, and Mr. Dilip Ratha, Lead Economist and Economic Adviser to MIGA’s Vice President of Operations.

“This bond, ably guided by MIGA’s expertise, has the potential to be transformative both in terms of providing much-needed affordable financing for high-impact, people-centered priority projects that are aligned with our national development goals.” Mudavadi said during the meeting.

The proposed Diaspora Bond is expected to offer a secure investment avenue for Kenyans living abroad who want to be involved in the development of their home country while reaping competitive returns.

Proceeds from the bond are likely to be apportioned to essential spheres of spending like infrastructure, health, education, and other development projects in line with Kenya’s Vision 2030 goals.

Others who attended this meeting include Mr. Livingstone Bumbe, the Deputy Director for Public Debt Management at the National Treasury, and Mudavadi’s key advisers like Ms. Anne Olubendi and Mr. Jamshed Ali.

Their participation underlined the importance of the bond in the country’s wider economic and public debt management strategy.

MIGA participation in the investment should, therefore, be instrumental in ascertaining the success of the bond through the mitigation of risk and guarantees, elements considered vital in increasing investor confidence.

He added that Mudavadi was hopeful the partnership with MIGA would ensure that the bond has competitive terms while adhering to international best practice in investment.

This meeting is a major step toward realizing the reality of the Diaspora Bond as Kenya continues to explore new avenues toward financing her development goals in a sustainable and inclusive manner.