Highlights from the Finance Bill 2025: Key Tax Proposals and Reforms Unveiled by Parliament

The proposed changes aim to streamline tax administration, eliminate outdated provisions, and boost revenue collection, all without introducing new tax rates.

Parliament unveils Finance Bill 2025 with major tax law amendments covering income tax, VAT, Excise Duty, and more.

By Robert Assad

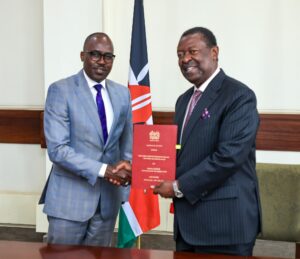

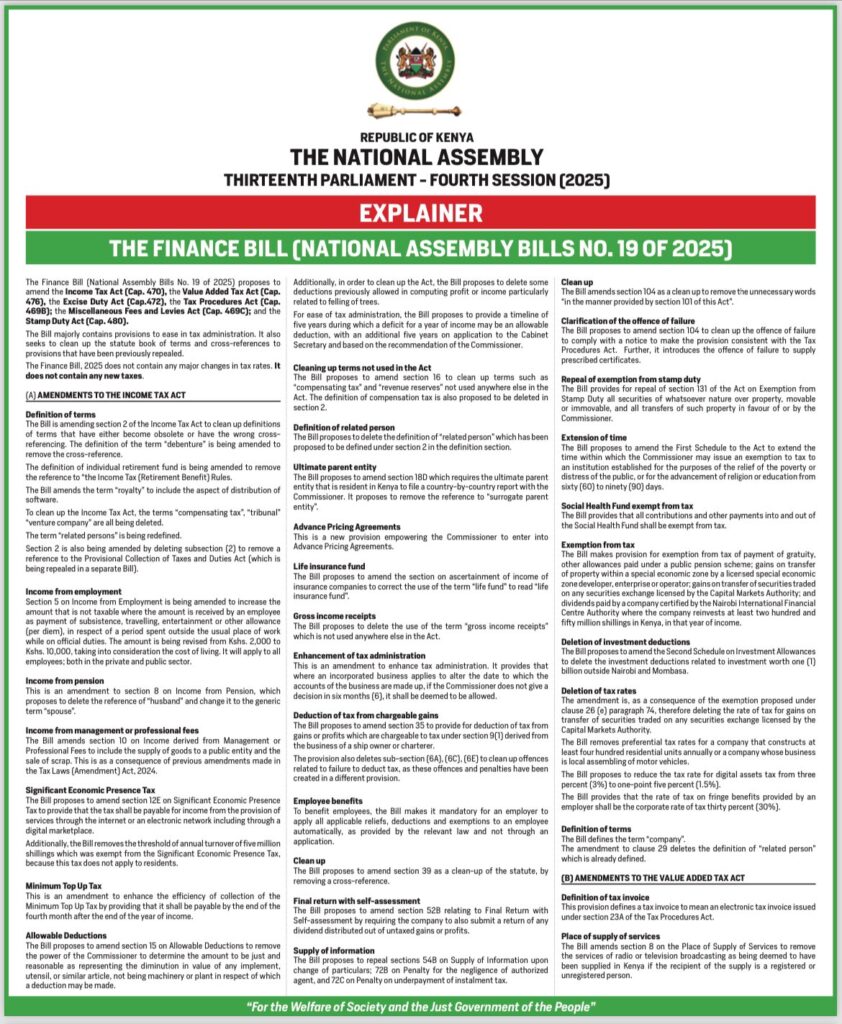

The National Assembly has unveiled the Finance Bill (National Assembly Bills No. 19 of 2025), outlining major amendments to several tax laws, including the Income Tax Act, VAT Act, Excise Duty Act, Tax Procedures Act, Miscellaneous Fees and Levies Act, and the Stamp Duty Act.

The proposed changes aim to streamline tax administration, eliminate outdated provisions, and boost revenue collection, all without introducing new tax rates.

Among the key proposals is a revision of the Income Tax Act, which includes redefining terms such as “related person” and “ultimate parent entity,” and reviewing income from pensions and employment.

Benefits like airtime, travel, and accommodation provided by employers will now be taxed more clearly.

Additionally, definitions such as “gross income receipts” will be incorporated, and relief on insurance and pensions clarified. The Bill also empowers the Commissioner to assess taxes even in cases where records are falsified or absent.

On Value Added Tax (VAT), the Bill proposes mandatory use of certified electronic tax invoice systems and expands VAT application to digital services provided remotely to Kenyan residents, including by non-resident entities.

For Excise Duty, new taxes are proposed on imported plastic products, except those originating from East African Community (EAC) states. Exemptions are introduced for electric bicycles, battery electric vehicle (BEV) stoves, and locally assembled phones, while tariff classifications for motorcycles and phones have been updated.

The Tax Procedures Act will also see changes, notably a reduction in the time frame for claiming tax refunds from 24 months to 12 months.

The Bill tightens enforcement mechanisms for failure to deduct or remit taxes and provides for real-time data access to enhance compliance monitoring.

The Stamp Duty Act will be amended to clarify exemptions for internal corporate restructures, and outdated fees under the Miscellaneous Fees and Levies Act will be repealed.

In support of the agricultural sector, the Bill grants tax exemptions on inputs for animal feed manufacturing and sugarcane transportation, subject to Cabinet approval. It also retains key incentives for Special Economic Zones (SEZs) under tighter regulatory oversight.

The Finance Bill, 2025, according to the National Assembly, is intended to enhance tax compliance, curb revenue leakages, and strengthen public service delivery.

Clerk of the National Assembly, S. Njoroge, confirmed that the Bill is available for public scrutiny both at Parliament and on official online platforms. Public participation and legislative debate are expected in the coming weeks before the Bill is enacted into law.