Government Weighs KSh 6 Billion Hustler Fund Loan Write-Off Amid Widespread Defaults

Loan amounts ranged from KSh 500 to KSh 50,000, with low interest rates designed to support micro-enterprises and boost financial inclusion.

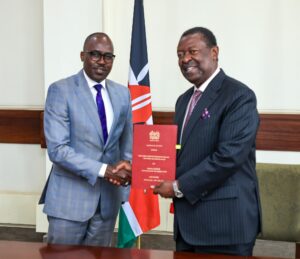

Government mulls writing off over KSh 6 billion in Hustler Fund loans after widespread borrower defaults. Photo/Daily Nation.

By Kemuma Achieng

The government is considering writing off over KSh 6 billion in unpaid loans disbursed through the Hustler Fund, following mass defaults by borrowers who received the money two years ago.

Appearing before the National Assembly Committee on Trade, Industry, and Cooperatives, Principal Secretary for Cooperatives Patrick Mag’eni confirmed that the Ministry is evaluating the option due to the growing number of non-performing loans.

The bad debt affects approximately 10 million Kenyans.“The reality is that the borrowers have failed to repay the loans despite multiple reminders and flexible repayment options,” said Mag’eni. “The government will be seeking to write off bad loans amounting to KSh 6 billion borrowed by 10 million Kenyans in 2024.”

The Hustler Fund, launched in late 2022 as a flagship initiative of President William Ruto’s administration, aimed to offer affordable, collateral-free loans to small traders, youth entrepreneurs, and low-income earners.

Loan amounts ranged from KSh 500 to KSh 50,000, with low interest rates designed to support micro-enterprises and boost financial inclusion.

However, government data now shows a significant default rate, raising concerns about the fund’s sustainability. Legislators questioned the long-term impact of forgiving billions in unpaid loans and whether such a move might encourage further defaults or weaken fiscal discipline.

“This is a learning curve,” Mag’eni told the committee. “We have identified the gaps and are working on a more sustainable credit system.”

Despite the challenges, the government maintains its commitment to supporting small businesses and informal traders. The Ministry is said to be exploring new models to strengthen loan security and improve recovery in future disbursements.

Great Story, so simple and easy to understand