Financial experts call for Financial Literacy over the Hustler Loans

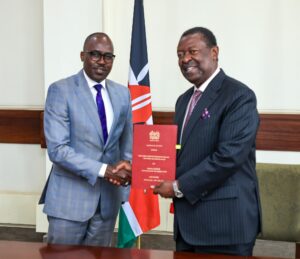

President William Ruto During the launch of the Hustler Fund /Photo State House Kenya

By James Gitaka

There is a need for the National and County Governments to roll out financial literacy that allows individuals to make informed and effective decisions with the hustler loans provided by the government to millions of Kenyans.

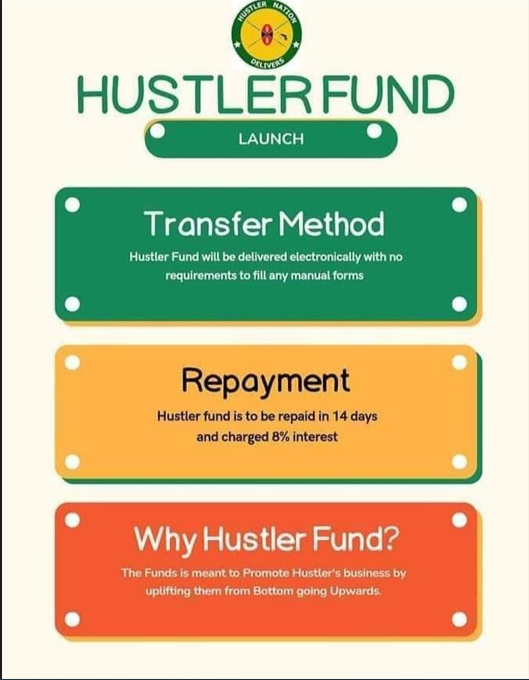

Financial Expert David Kemei Rotuk says lending has a close effect on economic growth and will benefit business people immensely with the Low interest rates that are 4% below other financial lenders including Banks and Microfinance Institutions.

“The Hustler Fund has a single digit interest rate, entrepreneurs will purchase capital goods which would spur a higher economic growth enabling Kenyans and especially the Micro and medium entrepreneurs expand their businesses hence creating more employment opportunities,” Said Kemei.

Speaking to the press in Eldoret town Rotuk however underscored the need for the Government’s line ministries including the County Governments Cooperative departments to roll out financial literacy programs in order to empower millions of youth benefitting from the Hustler Loans .

“I want to thank president William Ruto for launching the hustler fund as promised during the electioneering period. I want to urge both the National and County government to come up with a program that will sensitize Kenyans on how to use the funds since most of them are using the loans for their personal use and not businesses, these loans are meant to spur economic development and hence the need to educate the youth on prudent use of such funds,” Said the financial expert.

He noted that Kenyans should keep in mind that the Hustler fund needs to be repaid back in order to benefit more Kenyans

“National government through the Ministry of cooperatives should partner with County governments to ensure that the funds are put into prudent use, I urge Kenyans who have already received the loans to ensure they pay back as stipulated including the accruing interests in order to build on their credit score which will enable them get more funding from other financial lenders, “He added.

“Before taking a loan ensure you know the business you want to do, and if you have a business ask yourself how you intend to use the loan to expand your business and have an elaborate plan on how you will pay the loan on time as stipulated . After asking yourself those questions you can now get a loan,” said the financial expert.

According to the Cooperative and MSME development cabinet Secretary Simon Chelugui ,over Ks 1 Billion has been disbursed to over Five Million Kenyans who have opted in for the Hustler Fund .

John Rugut a shoe shiner from Eldoret is one of the over five million Kenyans who have already benefited with the loan of Sh500 which he has used to boost his shoe shine business within Eldoret town.

“I received sh 500 from the Hustler fund which has helped me to buy a new brush and shoe polish and I am sure I will get a profit to repay the loan and after that I intend to borrow some more money to better improve my stock,” John Rugut said.

Jeremiah Wainana a trader who deals with the sale of Mitumba clothes in Eldoret has however decried the loan limit saying the current amount of money is a drop in the ocean.

“We want the government to increase the loan limit from sh 500 to at least 20,000 ,with that kind of money we can be sure to expand our businesses and employ more young people, Sh 500 is just way too little,” he added.

More than 15 million Kenyans will benefit from the newly-launched Financial Inclusion Fund which is part of the Government’s plan to supporting Kenyans with products that are responsive to their enterprises.